| Fed Leaves Interest Rates Unchanged and Signals 3 Cuts in 2024 Federal Reserve Chair Jerome Powell’s decision to maintain short-term interest rates steady until the end of 2023 signals a potential shift in the commercial real estate market for 2024. Despite inflation-fighting rate hikes earlier in the year, Powell plans to cut rates three times in 2024 to address eased but still elevated inflation levels. Analysts predict a slow start in CRE transactions for early 2024, with potential acceleration in the latter half if interest rates decline as forecasted by Moody’s Analytics, which anticipates 2-3 rate cuts starting late in Q2 of 2024. The expected decline in interest rates, coupled with a recent drop in the 10-year Treasury rate, is poised to revitalize the CRE capital market, particularly in refinancing distressed properties. The market’s anticipation of deeper rate cuts than the Fed’s projections suggests a significant decrease in the federal funds rate by the end of 2024, potentially easing pressures on long-term debts and offering flexibility in the refinancing market, setting a unique stage for CRE in 2024 that balances cautious optimism with the pursuit of new deals. |

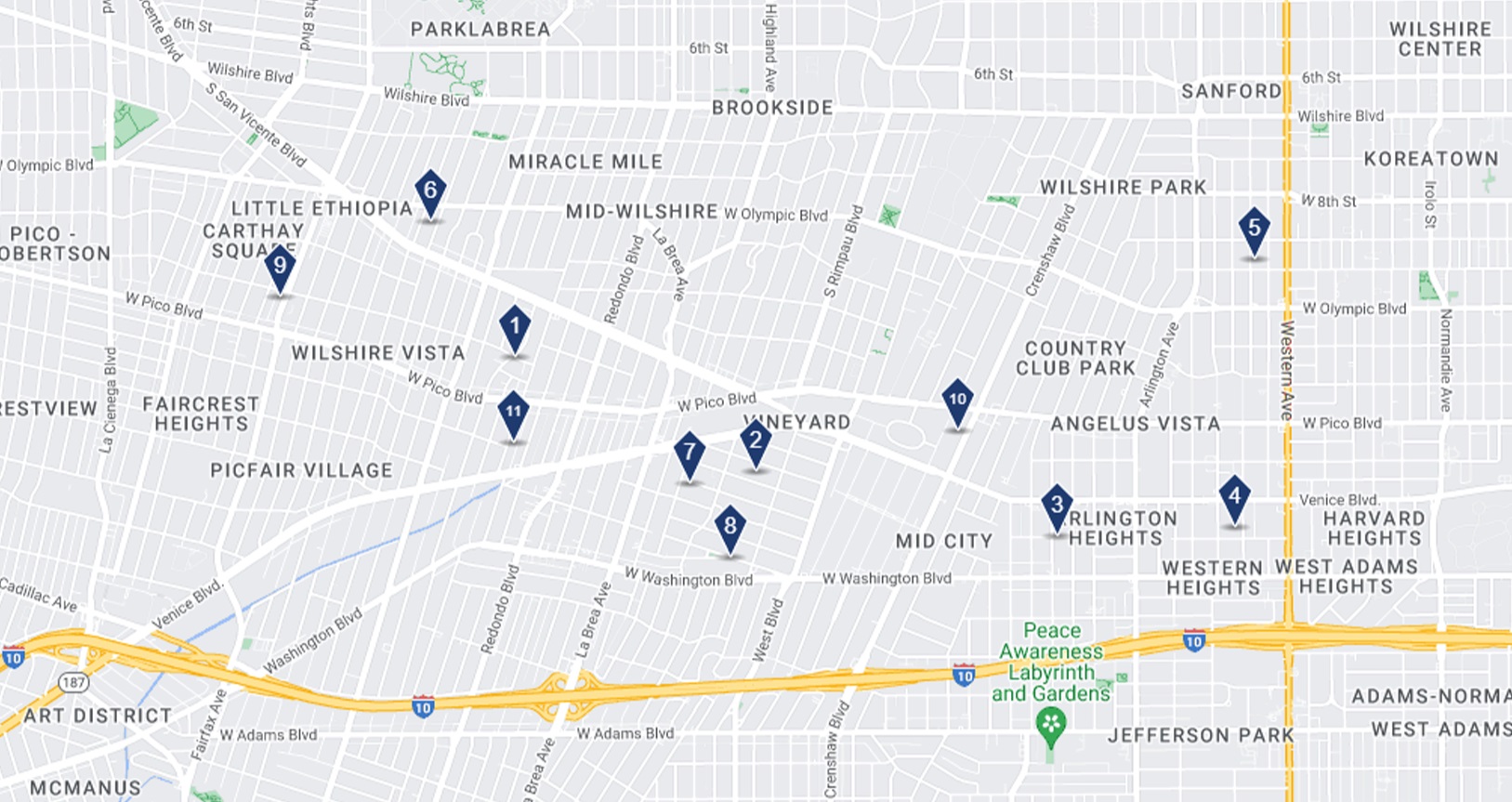

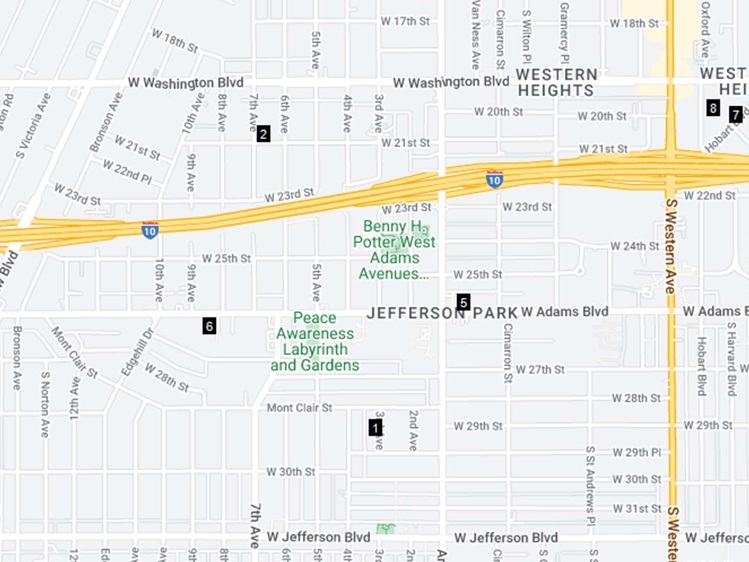

| Yardi Matrix Los Angeles Rental Report Los Angeles is experiencing a pronounced economic slowdown compared to other metros, with rent development remaining flat on a trailing three-month basis through the first three quarters. On a year-over-year basis, rents increased by only 0.2%, 60 basis points below the national average, and job growth lagged behind the nation, with a 2.3% expansion rate as of July. Despite large infrastructure initiatives and ongoing development, investment activity in Los Angeles declined by 77.0% year-over-year to $1.2 billion in traded assets.To learn more, click HERE. |

| One Area In California Where Population is Growing California, once a population leader, has experienced a slowdown in growth. The exodus is most notable in major cities like Los Angeles due to skyrocketing costs, but the Central Valley is defying the trend, witnessing a population boom driven by higher birth rates and migration from expensive coastal areas. San Joaquin County in Northern California, benefiting from this inward migration, is projected to reach almost 1 million residents by 2060, fueled by a housing construction boom attracting Bay Area residents seeking affordability. Contrary to political speculations, the primary driver of the population slowdown appears to be the high cost of living, prompting hundreds of thousands of residents to leave the state, though a substantial number are choosing to relocate within California.To learn more, click HERE. |

| Have any feedback on these monthly updates? Email adamestrin@fredleedsproperties.com For More Information Please Visit www.FredLeedsAssetGroup.com |