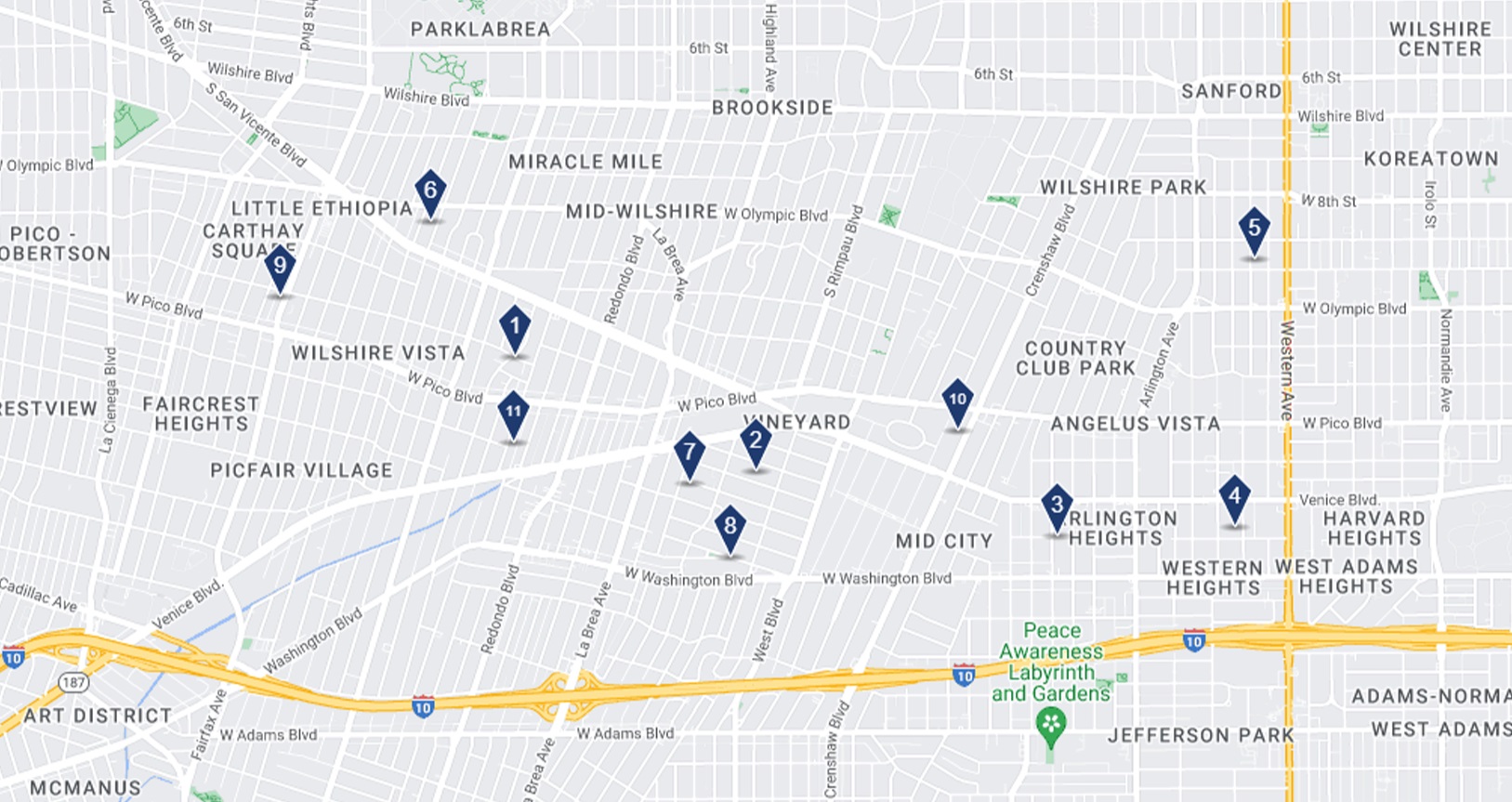

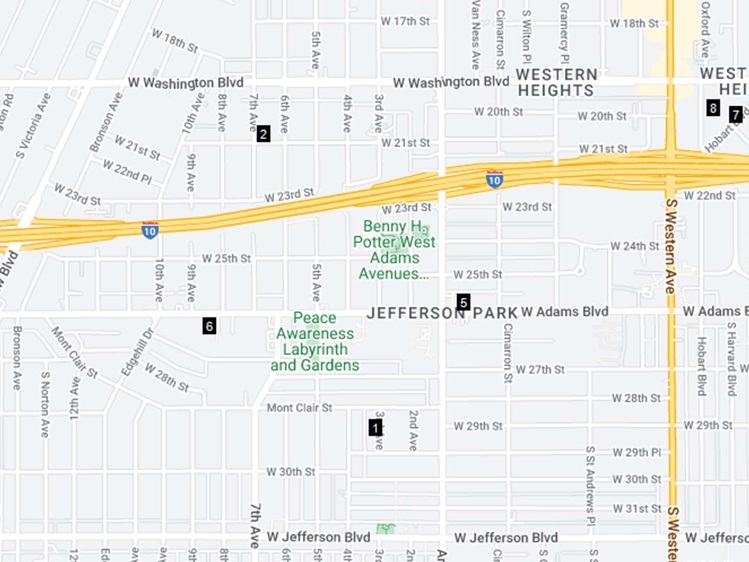

| 90035 Sales Data Last 6 Months (5+ Units) Key sales data for the last 6 months in Pico-Robertson (90035) for apartment buildings 5+ units.6 Deals ClosedAverage CAP rate: 5.47%Average GRM: 13.41Average Price/Unit: $299,879Average Days on Market: 73For a more comprehensive analysis or to learn about an adjacent submarket, please email me at adamestrin@fredleedsproperties.com |

Electrical Panels Facing Recalls and Insurance ImpactInsurance hurdles are increasingly prevalent for property owners in Los Angeles, with four electric panel distributors facing recalls. Here’s some information that may help you pass your next inspection. Being aware of these recalled electrical panels is essential for property safety and compliance in Los Angeles.Federal Pacific Electric (FPE) Stab-Lok panels:Widely used from the 1950s to the 1990s, these panels are prone to fire hazards due to failure to trip during overloads.Although not officially recalled, experts advise removal.Recognizable features include FPE stamping, specific information stickers, and breakers with red stripes.Zinsco panels:Found in many homes built or updated in the 1970s, especially in the western part of the county.Known for design flaws leading to fire hazards, such as insecure connections and corroding bus bars.Look for names like Zinsco, Sylvania, and GTE-Sylvania, as well as colored tabs on breakers.Challenger panels:Installed in homes during the 1980s and early 1990s, recalled in 1988 due to fire risks.Issues persisted even after acquisition by Eaton/Cutler Hammer, with further recalls in 2014.Identifiable features include stamped handles or doors and circuits with yellow buttons and “test” labels.Pushmatic panels:Popular from 1950 to 1980, recognized by their unique rectangular buttons.While not initially associated with fire hazards, they are now considered outdated and should be replaced due to compatibility issues with new components. Electrical Panels Facing Recalls and Insurance ImpactInsurance hurdles are increasingly prevalent for property owners in Los Angeles, with four electric panel distributors facing recalls. Here’s some information that may help you pass your next inspection. Being aware of these recalled electrical panels is essential for property safety and compliance in Los Angeles.Federal Pacific Electric (FPE) Stab-Lok panels:Widely used from the 1950s to the 1990s, these panels are prone to fire hazards due to failure to trip during overloads.Although not officially recalled, experts advise removal.Recognizable features include FPE stamping, specific information stickers, and breakers with red stripes.Zinsco panels:Found in many homes built or updated in the 1970s, especially in the western part of the county.Known for design flaws leading to fire hazards, such as insecure connections and corroding bus bars.Look for names like Zinsco, Sylvania, and GTE-Sylvania, as well as colored tabs on breakers.Challenger panels:Installed in homes during the 1980s and early 1990s, recalled in 1988 due to fire risks.Issues persisted even after acquisition by Eaton/Cutler Hammer, with further recalls in 2014.Identifiable features include stamped handles or doors and circuits with yellow buttons and “test” labels.Pushmatic panels:Popular from 1950 to 1980, recognized by their unique rectangular buttons.While not initially associated with fire hazards, they are now considered outdated and should be replaced due to compatibility issues with new components. |

| Apartment List March 2024 Report The Apartment List March 2024 Rent Report for Los Angeles indicates that the overall median rent remains stable at $2,061, with a year-over-year decrease of 3.9%. Despite being ranked as the #15 most expensive large city in the U.S., Los Angeles experienced a modest 0.2% increase in rents over the past month, placing it at #40 among large U.S. cities for rent growth. Comparatively, the wider Los Angeles metro area has a median rent of $2,160, indicating that the city proper’s median price is 4.6% lower than the metro-wide median.To learn more, click HERE. |

| Property values are dynamic in this current market given our higher interest rate environment, city regulations, building restrictions, etc. Are you curious how these factors have affected the value of your property? Click the button below for a free property valuation. |