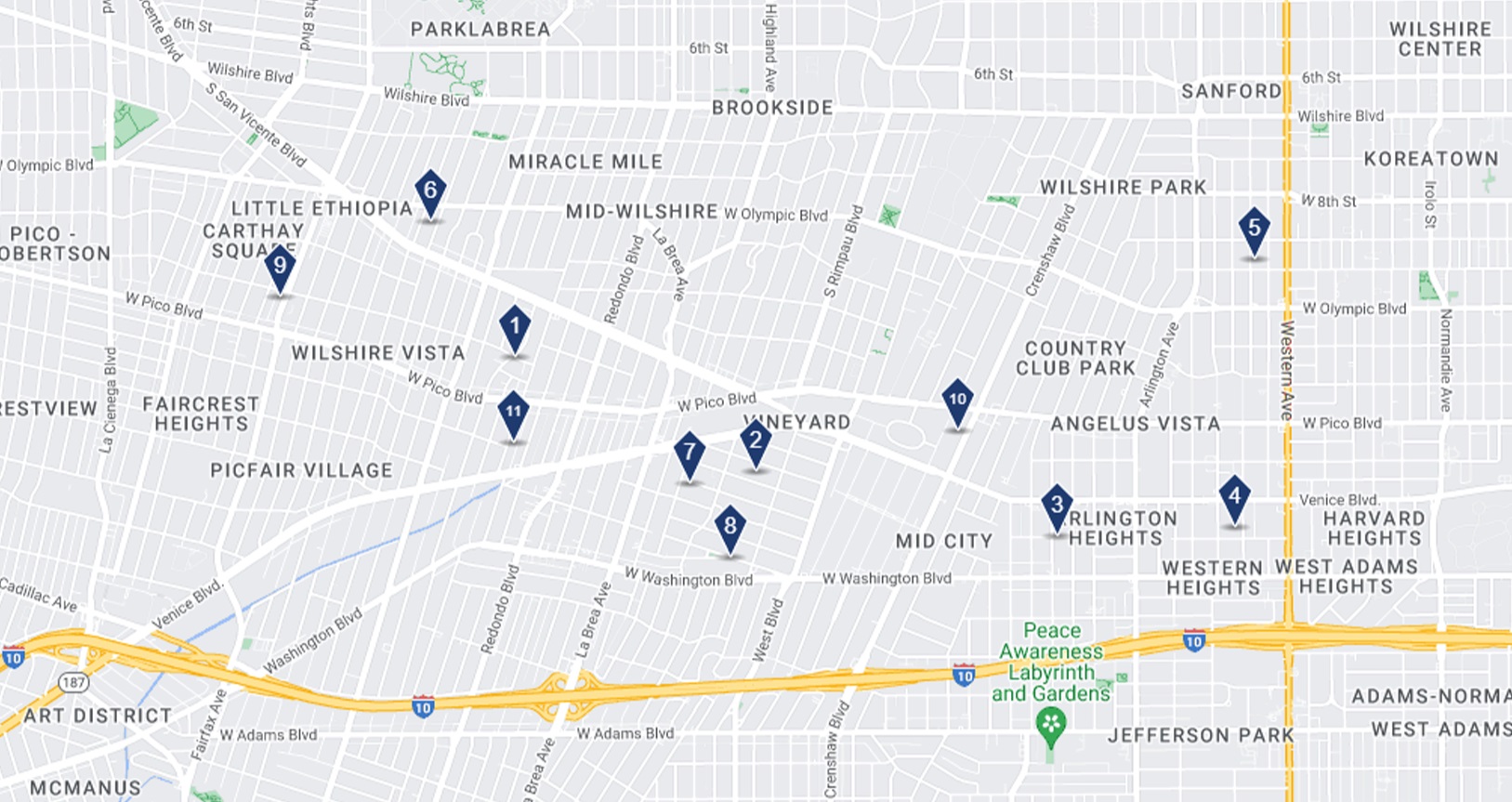

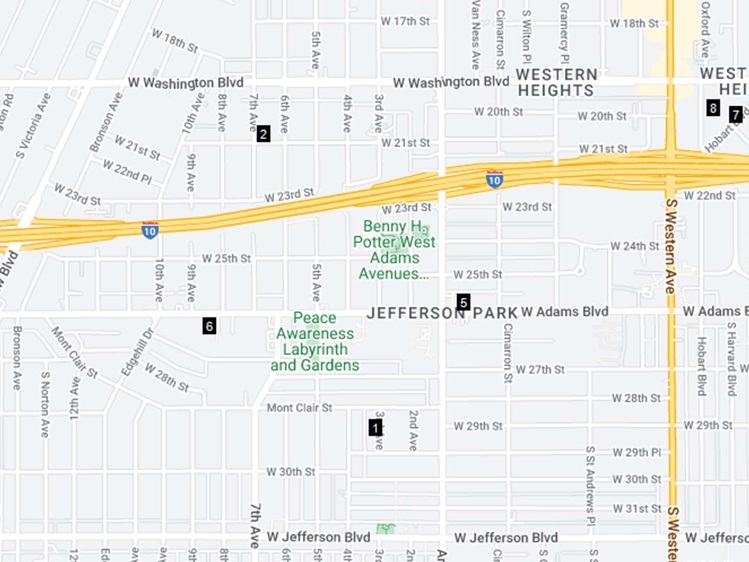

| 90034 Sales Data Last 6 Months (5+ Units) Key sales data for the last 12 months in Palms for apartment buildings 5+ units.4 Deals ClosedAverage CAP rate: 4.37%Average GRM: 13.55Average Price/Unit: $310,784Average Days on Market: 61For a more comprehensive analysis or to learn about an adjacent submarket, please email me at adamestrin@fredleedsproperties.com |

National Rent Growth Forecast For 2024 National Rent Growth Forecast For 2024RealPage’s updated forecast for the first quarter of 2024 indicates positive economic trends for the multifamily industry. Rent growth projections for the year suggest varied increases across major markets, with 12% expected to see growth of 3% or higher. Job additions remained strong in early 2024, particularly in cities like Houston and Austin, leading to upward revisions in employment forecasts. Despite inflation concerns, potential interest rate cuts by the Federal Reserve are anticipated in the latter half of the year, contingent on job market performance. GDP growth is projected to slow to between 2.4% and 2.7%, yet consumer spending remains a significant driver, with retail sales expected to rise by about 2% in 2024.To learn more, click HERE. |

Yardi Matrix – Multifamily Loans Coming Due Face Stress Test Yardi Matrix – Multifamily Loans Coming Due Face Stress TestHigher interest rates, lower property values and a surge in supply will test the multifamily market in the next few years as loans come due on a large volume of properties. A review of Yardi Matrix’s database found that loans on more than 58,000 properties totaling $525 billion will mature over the next five years, nearly half of the total $1.1 trillion of loans currently backed by apartments. In the short term, through the end of 2025, loans on 6,800 properties totaling nearly $150 billion are set to mature.To learn more, click HERE. |

Measure ULA, A Year In ReviewMeasure ULA, implemented in Los Angeles a year ago, dubbed as a “mansion tax,” has fallen short of its promises, generating only $173.6 million as of March 8, far from the projected $600 million to $1.1 billion annually. The tax, which affects properties valued over $5 million, has hindered multi-family and commercial developments. Legal challenges, including a lawsuit by the Howard Jarvis Taxpayers Association, question its constitutionality, with hopes that it may be invalidated or subjected to a two-thirds vote requirement through the Taxpayer Protection and Government Accountability Act. Measure ULA, A Year In ReviewMeasure ULA, implemented in Los Angeles a year ago, dubbed as a “mansion tax,” has fallen short of its promises, generating only $173.6 million as of March 8, far from the projected $600 million to $1.1 billion annually. The tax, which affects properties valued over $5 million, has hindered multi-family and commercial developments. Legal challenges, including a lawsuit by the Howard Jarvis Taxpayers Association, question its constitutionality, with hopes that it may be invalidated or subjected to a two-thirds vote requirement through the Taxpayer Protection and Government Accountability Act. |