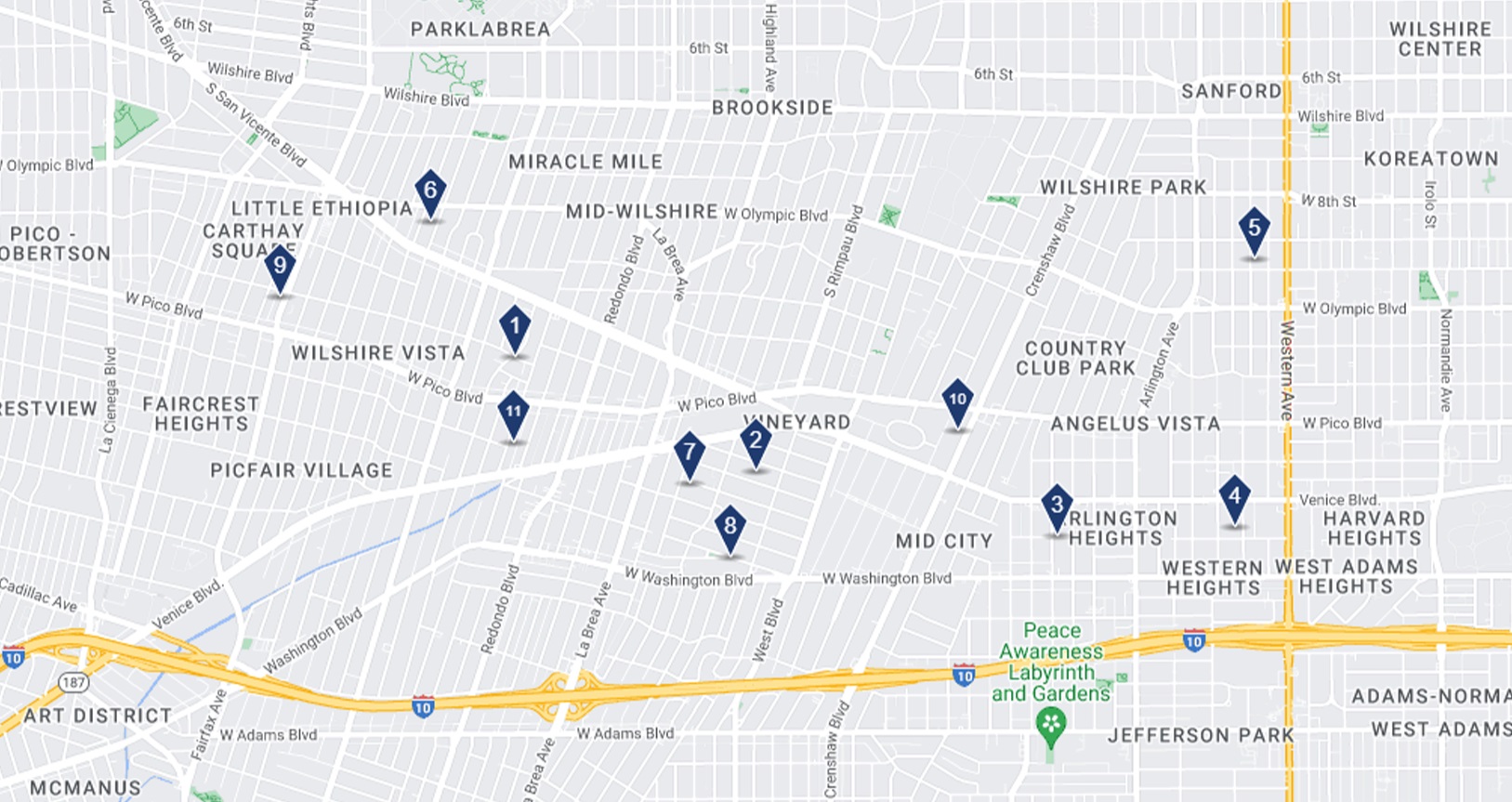

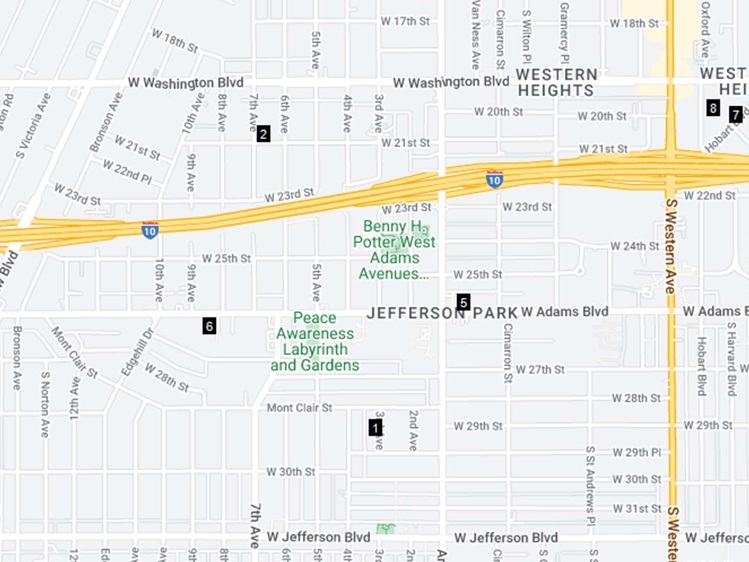

| 90019 Sales Data Last 6 Months (5+ Units) Key sales data for the last 6 months in Mid-City (90019) for apartment buildings 5+ units.11 Deals ClosedAverage CAP rate: 5.2%Average Price/Unit: $224,303Average Deal Size: 8.7 UnitsAverage Year Built: 1949For a more comprehensive analysis or to learn about an adjacent submarket, please email me at adamestrin@fredleedsproperties.com |

| Tenant Buyout Data (2019 – 2023) With an ongoing Los Angeles housing crisis here are some key metrics that underscore tenant buyout negotiations through COVID.4,869 Tenant Buyout agreements were filled$24,704 was the average buyout amount90004, 90026, 90019 were the top 3 Zip Codes with registered buyoutsTo learn more, click HERE. |

| ULA Tax Exemptions There has been confusion pertaining to LA’s “Mansion Tax” relating to potential exemptions depending on the status of the buyer, which you can read about HERE While it’s important to speak with your tax person/attorney since the topic is far from black and white, here are some potential exemptions that can possibly save you from paying ULA transfer tax.Non-profit entities under Internal Revenue Code section 501(c)(3) with a history of affordable housing development or management.Community land trusts or limited-equity housing cooperatives without a history of affordable housing development but recording an affordability covenant upon acquisition.Recognized 501(c)(3) entities with an IRS determination letter designation at least 10 years prior and assets under $1 billion.To learn more, click HERE. |

| Property values are dynamic in this current market given our higher interest rate environment, city regulations, building restrictions, etc. Are you curious how these factors have affected the value of your property? Click the button below for a free property valuation. |